Canada treats mining companies like the goose that laid the golden egg. What we get in return looks more like a goose egg.

This article was originally published in the November/December 2019 edition of the CCPA Monitor – a special edition on taxes.

Mining enjoys massive government support in Canada. Politically, it’s treated as a preferred development option for remote communities and Indigenous peoples. Former Saskatchewan premier Brad Wall once said, “The best program for First Nations and Métis people in Saskatchewan is not a program at all—it's [uranium mining company] Cameco.” The law backs this up. Mining companies still have rights to “free entry” in much of Canada, since mining is legally considered the “highest and best” use of land. Though these laws are being challenged by First Nations, today prospectors can stake claims and even drill or trench without any consideration for other land users, or in some cases, even private landowners.

There are also financial incentives to mine. The federal and provincial governments and territories spend hundreds of millions on road and power corridors to support mining projects, while supporting training for mining skills that are often not highly transferrable. Already low corporate tax rates are further reduced by accelerated capital cost allowances and deductions for exploration and development costs. “Flow-through” shares allow mining companies to pass exploration costs onto investors as tax deductions. And while they’ve been slowly getting better, Canadian jurisdictions still dramatically undercharge mining companies when it comes to setting aside money to clean up spills or for long-term environmental monitoring and rehabilitation.

All of this is justified publicly by the creation of jobs, contribution to GDP and exports—and taxes paid. Mining does create “good pay” jobs, though more of these are displaced from other sectors than the industry will admit. Mining does generate export earnings and boost GDP, though economists will argue about whether these really represent development, especially when what is being exported is raw materials with little value added. So, what of the taxes?

On paper, mining operations pay corporate tax and sales tax, among others, along with royalties (sometimes called “mining tax”) intended to compensate the state for the permanent loss of whatever resource is being extracted. Depending on the audience, mining companies will either brag or complain about the amount of tax they pay. They rarely explain how those amounts are calculated, much less compare them to what they might have had to pay if it weren’t for the lowered tax rates, tax holidays and exemptions. More egregiously, they also like to take credit for the taxes that their workers pay.

James Wilt, writing in The Narwhal in July last year, found that Canadian governments collect a smaller percentage of mineral value than almost any other jurisdiction in the world. There are a number of explanations for this, ranging from low tax rates to grace periods and tax holidays, as mentioned, to using a variable base for calculating royalties. Canada is unusual internationally, for example, in the extent to which it charges royalties based on profits rather than on the amount of mineral extracted, allowing for deductions and “profit-shifting” to diminish the amount owed.

In an extreme example, the CBC’s Rita Celli reported in May 2015 that in 2013-14, De Beers Canada paid the Ontario government $226 in royalties from its Victor Mine in Attawapiskat, the only diamond mine in the province. “The diamond royalty stirred a huge debate when the Ontario government suddenly introduced it in 2007,” wrote Celli. “Then-premier Dalton McGuinty promised it would enrich all Ontarians. He promised the money would be used to hire more nurses and keep class sizes small in schools.”

The low figure was due to De Beers having been allowed to write down its capital investment against the royalties. Tom Ormsby, De Beers’ vice-president of external and corporate affairs, told Celli the company started to pay millions in 2014. Its reports under Canada’s Extractive Sector Transparency Measures Act (ESTMA), in force since 2015, show it paid US$15.8 million in royalties in 2016 (on earnings of US$79 million) and US$11.3 million in 2017 (on earnings of US$205 million). The mine closed in early 2019. In other words, the mine probably generated almost nothing for the province for the entire first half of its production, and probably less than $100 million over its 11-year life.

Any assessment of the millions in taxes and royalties from mining operations has to include the overall value of the resource, as they remove many times more millions of dollars’ worth of metals. Any honest calculation also has to include not only the overall flow of money to governments, but also the subsidies, costs and liabilities, including social disruption and damage to local economies and the environment.

***

Internationally, the Canadian government takes the promotion of Canadian mining companies very seriously indeed. This is demonstrated by the fact that while Canadian and international civil society has been pushing for almost two decades for restrictions on the international activities of Canadian companies, the federal government has refused to recognize that illegal activity and human rights and environmental abuses are even happening, much less restrict them—or enforce the sole piece of legislation we do have, the anti-bribery Corruption of Foreign Public Officials Act.

At the same time, Canada provides massive support for transnational mining investment, both politically and economically. It helps explain why so many mining companies are domiciled in Canada, even if they have no Canadian operations, or even no Canadian directors, and regardless of who actually owns the majority of their shares.

Our embassies contribute “economic diplomacy,” which includes pressuring foreign governments to support favourable legislation and policies and helping build relationships between mining executives and foreign officials, such as mining ministers and state presidents. Canadian diplomats also provide support directly to companies, going so far as to help them comply with regulations and apply for permits. Even our development aid is skewed toward rewarding countries and regions that are willing to host Canadian mining projects, and assisting governments in administering mining laws so as to smooth the way for Canadian investment.

Economic support is both direct (investment from the Canada Pension Plan and Canadian Investment Fund for Africa, for example, or loans and political risk insurance from Export Development Canada) and indirect. Canada has built a massive network of tax treaties, bilateral investment treaties and free trade agreements that all serve to facilitate and protect Canadian investment, as well as allowing profits to be shifted through subsidiary companies to avoid taxation. It’s all perfectly legal, if you do it right.

The result is a ballooning offshore pool of wealth sitting in tax havens and secrecy jurisdictions in the Caribbean, Channel Islands, and even some U.S. states—wealth that is not taxed to benefit the countries it was extracted from, or even the country that worked so hard to facilitate it (in this case, Canada). Governments that try to protect their own people and ecosystems from mining destruction face the threat of multimillion-dollar lawsuits through arbitration provisions in those investment agreements.

To pick just one example, Eldorado Gold has been struggling for years to overcome committed local opposition to its planned Skouries open-pit gold mine in Halkidiki, northern Greece. Local people opposed to the massive project have raised objections over the destruction of a forest that is of immense cultural and historic significance—it is where local partisans gathered to strategize and mobilize against the fascists, and now serves as a focus for tourism, beekeeping, etc.—and the contamination of freshwater supplies (the ore is loaded with arsenic, among other things).

They have also questioned the promised benefits for the Greek state—with good reason. A study led by the Dutch organisation SOMO (the Centre for Research on Multinational Corporations) found the company has structured its investment with tax avoidance in mind. Subsidiaries in the Netherlands will allow Eldorado to shift profits from Greece to the Netherlands and Barbados, minimizing exposure to taxes and leaving Greeks with little to show for the mine’s ecological, social and economic disruption. SOMO calculated this arrangement had cost Greece 1.7 million euros in lost tax in 2013-14 alone (nearly $2.5 million based on the exchange rate at the time).

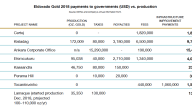

A look at Eldorado Gold’s payments to governments, as disclosed under ESTMA, shows that as of 2018, the company made significant payments in Turkey, where most of its gold production is, but nowhere else. Not even Canada, where it is supposedly headquartered, but also where it now operates the Lamaque Mine outside of Val-d’Or, Quebec.

What we don’t know is how much the company should have paid in the absence of what the accountants call “aggressive tax planning,” or what the rest of us call tax dodging. Nor does this accounting show how much has been set aside as security bond for closure, cleanup, and possible spills and accidents.

It makes sense that Turkey, as the primary host of Eldorado Gold’s operations, should benefit most. It’s an open question whether the country benefits enough to compensate for the loss of its gold-bearing ore, not to mention the various forms of damage occasioned by mining or the liabilities it leaves behind. And it’s more than likely that the company has minimized its exposure to Turkish taxes.

But at the same time, there is clearly no direct return for Canada from all of the support we provide. If share value increases or the company pays dividends we can benefit as shareholders—through our pensions, RRSPs or the Canada Pension Plan. But clearly the loot is mostly being scooped up by others: well-paid company executives, the banks that finance all of this, and the legal, accounting and investment houses.

At the end of the day, the notion that mining is good for Canada is pretty dubious. The reality within Canada is much more complex than our governments and most of the media are willing to admit. In other parts of the world, the reality is that Canadian mining primarily benefits the mining companies, their local backers, and their financiers. Its contributions to “host” countries are variable and on balance generally negative. Despite all the effort from public officials, Canada hardly benefits at all. It’s past time we started to dismantle the legal, regulatory, financial and political support that feeds and sustains this false narrative.