On November 21st, Nautilus Minerals' court-appointed monitor, Price Waterhouse Cooper (PwC) confirmed that the relevant legal papers had been filed to assign the company into bankruptcy.[1] Whilst this news was expected, there has been no news on plans for the Solwara 1 deep sea mining project in Papua New Guinea, leaving local communities and civil society who are opposed to the project with many questions.

Nautilus filed for protection from its debts in a Canadian court in February, 2019.[2] The company tried to restructure but it failed to find any buyers for its assets. In August 2019, court approval was obtained for creditors to liquidate the company in order to get back a fraction of what they were owed.[3]

Andy Whitmore of the Deep Sea Mining Campaign stated, “This should be the end of the story, but sadly the liquidation was enacted to give birth to a new, smaller Nautilus.”

“The two main shareholders – MB Holding and Metalloinvest – have effectively taken control of this ‘new’ Nautilus at the expense of major creditors and hundreds of small shareholders. Despite filing an appeal[4] in the Canadian court, through its company Eda Kopa, the PNG Government remains the biggest loser from the deal holding 15% equity in Nautilus PNG and the Solwara 1 project, effectively losing $US125m.”[5]

“Nautilus gave the impression that the new company was ready to roll.[6] But it has been over a month since the confirmation and there’s been no other information on what Nautilus’ new plans will be.”

“Nautilus stated in court papers[7] that, once liquidation occurs, there may still be a buyer for at least some of the new company’s assets.[8] Does this mean the major shareholders will sell their licences and machinery to make a quick profit and run?” questioned Whitmore.

Local communities opposed to Nautilus’ Solwara 1 project in their seas are still steadfastly opposed to the project, and there are still legal cases in the PNG court system.[9]

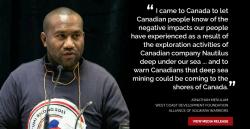

Jonathan Mesulam from the Alliance of Solwara Warriors has recently returned to PNG from meetings in Canada[10] where he represented the fierce opposition of PNG coastal communities against experimental seabed mining.

Mesulam stated, “It’s unbelievable for Nautilus to still consider mining the Solwara 1 project. Even if free of its long-term debt, this new company is created on the back of the huge financial loss for our government and the people of PNG. Our people want nothing to do with this company and its lies of prosperity. In Canada I learned that such a project would never be allowed in this company’s home waters.”

This loss adds to PNGs public debt which is at about 33 per cent of GDP. Australia has recently committed a $AUD300 million loan as direct budget assistance to ‘aid its economic reforms and government financing.’[11]

Mesulam continued, “A recent article in PNG Business News seems to suggest the ‘new’ Nautilus has applied to the PNG Mineral Resources Authority to vary the existing mining lease.[12] This is against a background of calls from right across Papua New Guinean society to cancel the licences.”[13]

An added mystery is that someone is still buying shares in the old, defunct company. When Nautilus was removed from the Toronto Stock Exchange as part of the bankruptcy proceedings, it moved to unregulated trading of the now virtually worthless stock. Yet there has been a recent spike in buying that sent the price up to 0.003 cents per share.[14]

“So many questions, and yet to date no answers. The company still looks to be lost at sea with no life raft in sight,” commented Whitmore.

For more information

Andy Whitmore, Deep Sea Mining Campaign (London), whit@gn.apc.org, +44 775 439 5597

Jonathan Mesulam, Alliance of Solwara Warriors (Papua New Guinea), mesulamjonathan@gmail.com, +675 7003 8933

NOTES

[1] Updates, Nautilus Minerals, Canadian Companies’ Creditors Arrangement Act (CCAA), PwC, https://www.pwc.com/ca/en/services/insolvency-assignments/nautilus-minerals-inc.html

[2] ibid.

[3] ‘Nautilus obtains court approval of plan of compromise and arrangement’, Nautilus Minerals media release, 13 August 2019, http://www.nautilusminerals.com/irm/PDF/2096_0/

[4] Eda Kopa filed an appeal in the Canadian Court, claiming they should be treated the same as other creditors, rather than as a shareholder, so at least they could salvage something. Nautilus fought this, complaining – among other arguments – that they could not afford to pay Eda Kopa. On 26th September the Court dismissed Eda Kopa’s appeal, and on 22 October it was confirmed that no further appeal would be submitted.

[5] Deep Sea Mining Campaign, London Mining Network, Mining Watch Canada. 2019. Why the Rush? Seabed Mining in the Pacific Ocean. July. pp 26. http://www.deepseaminingoutofourdepth.org/wp-content/uploads/Why-the-Rush.pdf; Table 29 of the PNG Treasury Final budget outcome released in March 2019 indicates expenditure by sector – the debt of $US125m alone, ignoring interest and other costs. equates to K422m at March 2019 exchange rates, http://bit.ly/FinalBudgetOutcome2018

[6] Monitors Sixth Report to Court, Nautilus Minerals, Canadian Companies’ Creditors Arrangement Act (CCAA), PwC, https://www.pwc.com/ca/en/car/nautilus-minerals/assets/nautilus-minerals-065_091919.pdf

[7] Monitors Sixth Report to Court, Nautilus Minerals, Canadian Companies’ Creditors Arrangement Act (CCAA), PwC, (section 5) https://www.pwc.com/ca/en/car/nautilus-minerals/assets/nautilus-minerals-049_072419.pdf

[8] The court papers also noted that Nautilus had two distinct business units, one dealing with polymetallic nodules, and one dealing with seafloor massive sulphides (which includes the Solwara 1 project in PNG). It is therefore unclear which, if either of the business units, the new company will concentrate on.

[9] ‘Legal action launched over the Nautilus Solwara 1 Experimental Seabed Mine’, statement 6 December 2017 – http://www.deepseaminingoutofourdepth.org/legal-action-launched-over-nautilus-solwara-1/; ‘World-first mining case launched in PNG’, Lawyers Weekly, 13 December 2017, https://www.lawyersweekly.com.au/wig-chamber/22429-world-first-mining-case-launched-in-png

[10] Where Does Canada Stand on Deep Sea Mining?, MiningWatch Canada and Alliance of Solwara Warriors media release, 22 November 2019, https://miningwatch.ca/news/2019/11/22/where-does-canada-stand-deep-sea-mining; Briefing: Jonathan Mesulam Meets with Senior Canadian Civil Servants on Deep Sea Mining, Ottawa, Canada, 18 November 2019,

[11] ‘Australia Gives $300 Million Loan to Papua New Guinea’, Reuters, 23 November 2019,https://www.reuters.com/article/us-pacific-loan-australia/australia-gives-300-million-loan-to-papua-new-guinea-idUSKBN1XX03W

[12] ‘Mine waits for restructure’, PNG Business News, 19 November 2019, https://www.pngbusinessnews.com/post/mine-waits-for-restructure

[13] ‘Joint Letter calling for the PNG Government to cancel all Nautilus Minerals deep sea mining licences’, full-page ad, Post Courier by PNG Council of Churches, Voice of Milne Bay, Alliance of Solwara Warriors, Bismarck Ramu Group and Centre for Environmental Law and Community Rights, 28 June 2019, http://www.deepseaminingoutofourdepth.org/joint-letter-calling-for-the-papua-new-guineagovernment-to-cancel-all-nautilus-minerals-deep-sea-mining-licences-and-to-ban-seabed-mining-in-png/ ; ‘Cancel all deep sea mining licences’, Loop PNG, April 24, 2019. http://www.looppng.com/business/cancel-all-deep-sea-mining-licences-locals-83822